cryptocurrency tax calculator uk

As a refresher short-term capital gains had a rate of 10 to 37 in 2021 while long-term capital gains had a rate of 0 to 20. Gain complete insight on how your crypto assets will be taxed.

Best Bitcoin Tax Calculator In The Uk 2021

Exchange your tokens for a different type of cryptoasset.

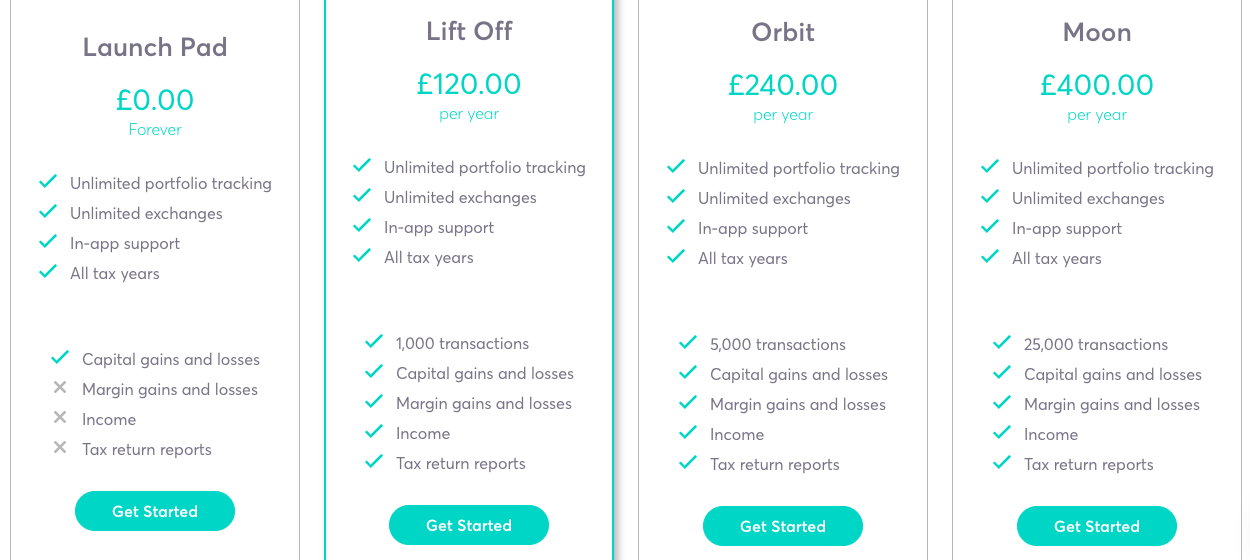

. Koinly is a popular platform with a crypto tax calculator available in over 20 countries including the UK. Allowances for tax-free capital gains in the UK by year source Cryptocurrency gifts to your spouse are also non-taxed and can effectively allow you to double your tax-free allowance in a given tax year. Cryptocurrency gains of 20000 staking income of 2000 with a salary of 50000.

Calculate the tax you owe as soon as you can to prepare for the bill. Cryptocurrency Tax Calculator. To help you along the way take a look at our Capital Gains Tax calculator here.

HMRC has published guidance for people who hold cryptoassets or cryptocurrency as they are also known explaining what taxes they may need to pay and what records they need to keep. You trade with crypto instead of fiat. The original software debuted in 2014.

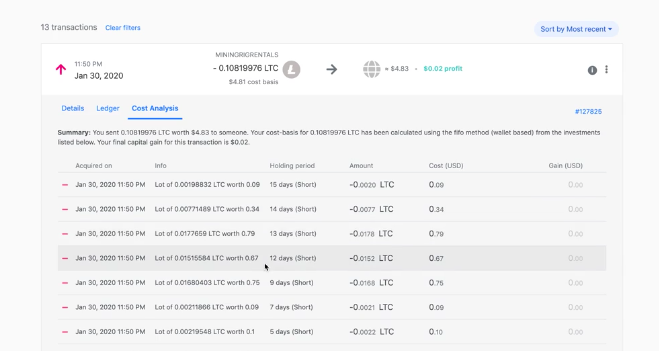

Calculating cryptocurrency in the UK is fairly difficult due to the unique rules around accounting for capital gains set out by the HMRC. Capital gains tax report. Since then its developers have been creating native apps for mobile devices and other upgrades.

The percentage you pay as crypto capital gains tax however depends on whether you. The Capital Gains tax allowance for the 202021 tax year was 12300. Buying and holding a crypto asset and then selling it at a future date attracts a capital gains tax.

See the full HMRC guidance here. You can also generate an Income report that shows your income from Mining Staking Airdrops Forks etc. UK citizens have to report their capital gains from cryptocurrencies.

How to calculate crypto taxes in the UK. With over 300000 users CoinTrackinginfo is one of the oldest and most trusted cryptocurrency tax calculators on the market today. This allowance includes crypto gains but also stock and property gains.

There is no exemption. Use our crypto tax calculator below to determine how much. 7700 taxed at 20 1540.

Once you calculate the amount of tax your business is liable to pay you will have to. However recall that there is a broad Capital Gains Tax allowance. You might need to pay Capital Gains Tax when you.

In general terms losses resulting from cryptocurrency trades are tallied against any gains made in the current year. Total CGT to pay 1540. Gifts to charity are also tax-free details.

In simple terms this means that unless. For example if you buy bitcoin at 10000 and sell it later for 13000 youre required to pay a capital gains tax on the gains realized which in this case is 3000. Capital Gains Tax is a tax you pay on your profits.

Capital Gains Tax. Purchase 1 bitcoin BTC for 100 and then sell it for 10000. The rate of CGT that you pay each year depends on the asset youve sold and how much you earn.

Trading allowance of 1000 0. Total income tax to pay 346. Youll then need to file and pay your Capital Gains Tax bill by 31st January each tax year.

Finally youll need to calculate the amount youll need to pay on Capital Gains Taxes and income tax based on your tax bracket. HMRC also suggests what cost you can deduct from disposal proceeds to calculate capital gain. This means you may owe taxes if your coins have increased in value whether youre using them as an investment or like you would cash.

730 taxed at 40 292. HMRCs latest regulations will impact cryptocurrency tax treatment in the UK. In the UK you have to pay tax on profits over 12300.

To calculate your capital gains as an individual the HMRC requires you to keep track of your average cost basis for the token on hand aggregate your same-day transactions and ignore any wash sales. Note however that first short-term losses are applied against short-term gains and long-term losses are applied against long-term gains. It makes calculating your capital gains easy by using Share Pooling and follows HMRCs guidelines.

Capital Gains Tax Allowance on Crypto. You would only be liable for any capital gains tax above that amount. Latest news and advice on cryptocurrency taxes.

Capital Gains Tax allowance of 12300 0. Why is there a crypto tax UK. When to check.

Then youll need to specify the buy and sell date of your assets. Tax-Loss Harvesting With A Crypto Tax Calculator. Use your tokens to pay for goods or services.

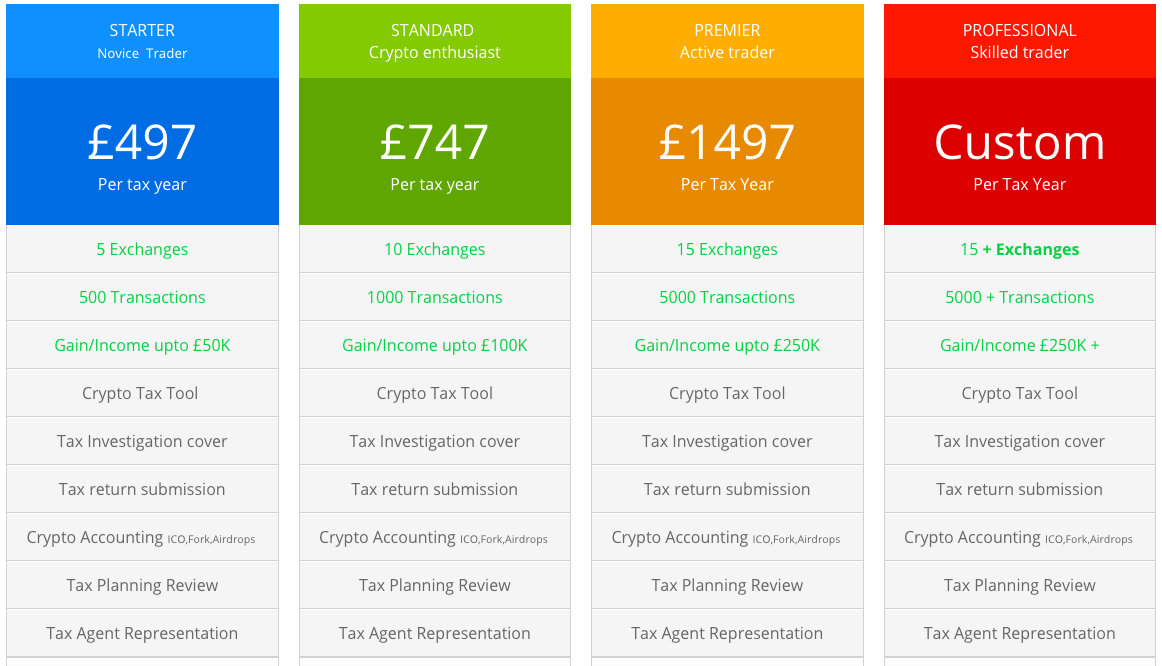

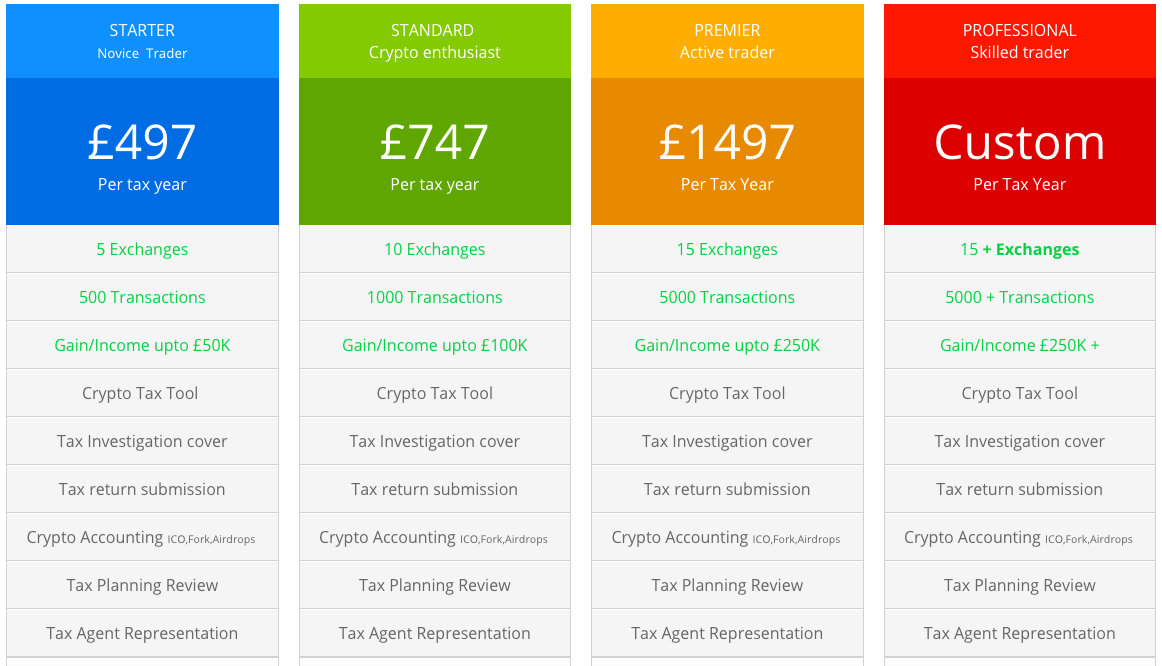

The platform is also to start using Koinlys crypto tax calculator. CoinTrackinginfo - the most popular crypto tax calculator. In both the 202122 and 202223 tax years UK residents are given an annual capital gains tax allowance of 12300.

Coinpanda generates ready-to-file forms based on your trading activity in less than 20 minutes. The rate you pay on crypto taxes depends on your taxable income level and how long you have held the crypto. File your crypto taxes in the UK Learn how to calculate and file your taxes if you live in the United Kingdom.

You can start using Koinly for free and only pay when youre ready to generate reports. Detailed case studies tutorials. 270 taxed at 20 54.

Your cryptocurrency tax rate on federal taxes will be the same as your capital gains tax rate. It helps you calculate your capital gains using Share Pooling in accordance with HMRCs guidelines. Your business is back by cryptocurrency ie.

Koinly helps UK citizens calculate their crypto capital gains. For individuals income tax supersedes capital gains tax and applies to profits. For companies profits or losses from cryptocurrency trading are part of the trading profit rather than a chargeable gain.

You declare anything youve earned from selling an asset over a certain threshold via a tax return. Koinly is the most popular software to calculate crypto taxes. Youll need to separate all your transactions into capital gains transactions and income transactions.

Start for free pay only when you are ready to generate your. Learn how cryptocurrencies are taxed in your country. The software is available in over 20 countries including the UK.

How To Calculate Your Uk Crypto Tax

Bitcoin Taxes Crypto Portfolio Prices Cointracker

Capital Gains Tax Calculator Ey Global

Calculateme Com Calculate Just About Everything Area Of A Circle Gas Mileage Calculator

Best Bitcoin Tax Calculator In The Uk 2021

Top 10 Uk Exchanges To Get Crypto Tax Reports Koinly

Cryptocurrency Tax Calculator Forbes Advisor

Best Bitcoin Tax Calculator In The Uk 2021

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Best Bitcoin Tax Calculator In The Uk 2021

Top 10 Uk Exchanges To Get Crypto Tax Reports Koinly

Best Bitcoin Tax Calculator In The Uk 2021

Declare Your Bitcoin Cryptocurrency Taxes In Uk Hmrs Koinly

Add Your Sources Of Cryptocurrency Income From The Tax Year Tax Software Cryptocurrency Taxact